An Analytical Study on Electricity Demand in Nepal

October 31, 2025 | Investopaper

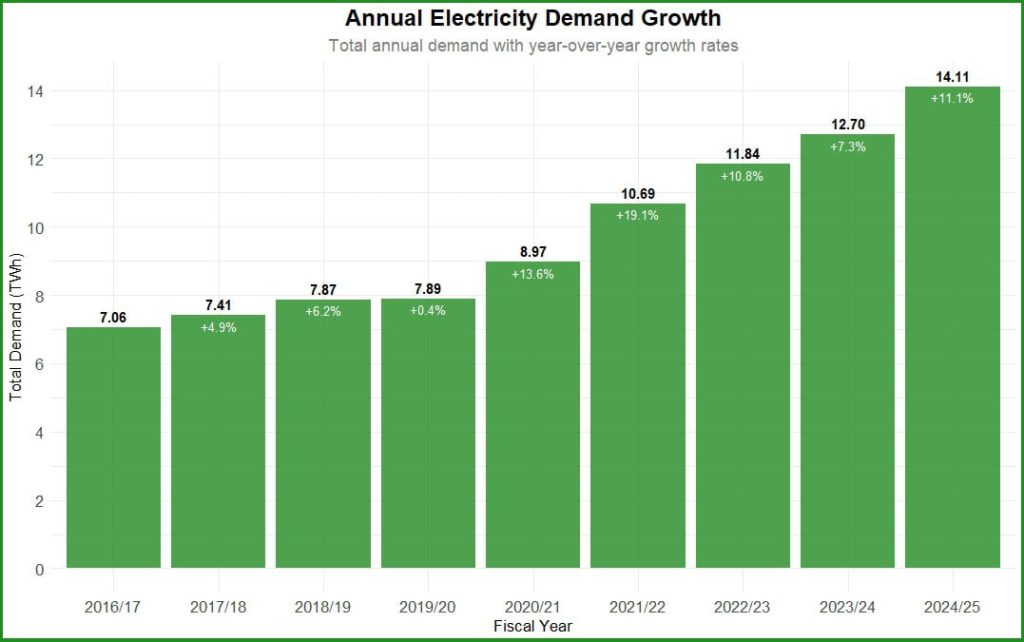

The demand of electricity in Nepal, as reported by the Nepal Electricity Authority, has exhibited robust growth over the fiscal years 2016/17 to 2024/25. Total annual demand has more than doubled, rising from 7.06 TWh in 2016/17 to 14.11 TWh in 2024/25, driven by economic expansion, increasing electrification and exports.

This study report provides a comprehensive breakdown of trends, supported by visualizations, statistical summaries, and projections.

Data Description

The dataset (sourced from Nepal Electricity Authority) comprises monthly electricity demand (in MWh) for Nepal from fiscal year 2016/17 to 2024/25, covering 9 years and 108 observations (12 months per year). Fiscal years run from mid-July to mid-July, with months labeled August through July. Demand is aggregated at the national level by the Nepal Electricity Authority.

Time Series Analysis

The time series plot reveals a consistent upward trajectory in monthly demand, superimposed with clear seasonal oscillations. From August 2016 to July 2025, demand escalates from approximately 550 GWh to over 1,400 GWh, with a trend line confirming non-linear acceleration post-2020. Seasonal peaks align with monsoon/summer periods, while troughs occur in late winter.

Figure 1: Nepal’s Monthly Electricity Demand (2016-2025)

Annual Growth Analysis

Annual totals show steady expansion, with a brief stagnation in 2019/20 (0.36% YoY) likely due to COVID-19 disruptions, followed by a sharp rebound (13.6% in 2020/21). Peak months consistently shift to summer (e.g., July in recent years), reflecting irrigation and hydropower seasonality.

| Fiscal_Year | Total_Demand (GWh) | Avg_Monthly (GWh) | Peak_Month | Peak_Demand (GWh) | YoY_Growth (%) | CAGR (%) |

|---|---|---|---|---|---|---|

| 2016/17 | 7,064.51 | 588.71 | Jun | 647.70 | NA | 0.00 |

| 2017/18 | 7,408.57 | 617.38 | Jul | 733.06 | 4.87 | 4.87 |

| 2018/19 | 7,866.17 | 655.51 | Jun | 783.77 | 6.18 | 5.52 |

| 2019/20 | 7,894.17 | 657.85 | Sep | 826.14 | 0.36 | 3.77 |

| 2020/21 | 8,969.06 | 747.42 | Jul | 842.62 | 13.60 | 6.15 |

| 2021/22 | 10,686.17 | 890.51 | Jul | 1,110.24 | 19.10 | 8.63 |

| 2022/23 | 11,838.08 | 986.51 | Jul | 1,194.45 | 10.80 | 8.98 |

| 2023/24 | 12,700.98 | 1,058.42 | Jun | 1,336.49 | 7.29 | 8.74 |

| 2024/25 | 14,114.94 | 1,176.25 | Jul | 1,482.56 | 11.13 | 9.04 |

Figure 2: Annual Electricity Demand Growth

Seasonal Pattern Analysis

Averaged across years, demand peaks in July (973.45 GWh) and June (938.78 GWh) while December (703.12 GWh) and November (708.36 GWh) represent lows.

| Month | Avg_Demand (GWh) | SD_Demand (GWh) | Min_Demand (GWh) | Max_Demand (GWh) |

|---|---|---|---|---|

| Aug | 909.62 | 243.10 | 636.18 | 1,321.23 |

| Sep | 892.64 | 231.90 | 640.06 | 1,304.90 |

| Oct | 816.52 | 193.60 | 569.77 | 1,138.54 |

| Nov | 708.36 | 159.14 | 554.16 | 969.19 |

| Dec | 703.12 | 168.36 | 518.20 | 996.37 |

| Jan | 758.25 | 179.13 | 538.88 | 1,061.45 |

| Feb | 756.60 | 192.49 | 536.28 | 1,067.26 |

| Mar | 742.28 | 185.50 | 543.88 | 1,012.61 |

| Apr | 780.89 | 220.93 | 510.87 | 1,136.43 |

| May | 857.57 | 277.49 | 485.53 | 1,268.25 |

| Jun | 938.78 | 290.17 | 647.70 | 1,356.14 |

| Jul | 973.45 | 289.32 | 646.66 | 1,482.56 |

Figure 3: Seasonal Demand Patterns (2016-2025 Average)

Heatmap Visualization

Figure 4: Monthly Electricity Demand Heatmap

Monthly Growth Rate Distribution

YoY growth rates vary by month, with medians highest in April (15.2%) and May (18.4%). Overall median growth is 8.7%, with outliers in 2021/22.

Figure 5: Distribution of Year-over-Year Growth Rates by Month

Comparative Analysis Across Years

Figure 6: Monthly Demand Comparison Across Fiscal Years

Comprehensive Statistical Summary

1. Overall Statistics (2016-2025)

Total Period Demand: 88.54 TWh

Average Monthly Demand: 819.84 GWh

Minimum Monthly Demand: 485.53 GWh (May 2019/20)

Maximum Monthly Demand: 1,482.56 GWh (Jul 2024/25)

2. Compound Annual Growth Rate (CAGR)

Overall CAGR (2016/17-2024/25): 9.04%

3. Seasonal Insights

Highest demand months: Jul, Jun, Aug

Lowest demand months: Dec, Nov, Mar

4. Recent Trends (2024/25)

Average monthly demand: 1,176.25 GWh

Peak month: Jul (1,482.56 GWh)

Growth vs 2023/24: 11.13%

5. Volatility Analysis

Coefficient of Variation: 28.04%

Standard Deviation: 229.90 GWh

Forecasting

A seasonal ARIMA model (1,1,1)(0,1,1)[12] was fitted to the time series, capturing differenced trends and monthly cycles (AIC: 2,376.25; sigma²: 3.72e+09). The model forecasts 12 months ahead (through July 2026), projecting stabilization around 1,400-1,500 GWh with upper/lower confidence bands widening seasonally.

Figure 7: 12-Month Electricity Demand Forecast

Conclusion

Nepal’s electricity demand trajectory underscores a success story of energy access expansion. The compound annual growth rate (CAGR) stands at 9.04%, with year-over-year (YoY) fluctuations ranging from 0.36% to 19.1%. Seasonal patterns are pronounced, with peak demand in summer months (June, July, August) due to agricultural irrigation, cooling needs, and industrial activity, contrasting with lower winter demand (November, December, March).

Key insights include:

Overall Growth: Average monthly demand increased from 588.71 GWh to 1,176.25 GWh, with a coefficient of variation (CV) of 28.04% indicating moderate volatility.

Seasonal Peaks: July averages 973.45 GWh, while December averages 703.12 GWh.

Recent Trends: 2024/25 shows an 11.13% YoY increase over 2023/24, with July 2024/25 reaching a record 1,482.56 GWh.

Forecast: An ARIMA(1,1,1)(0,1,1)[12] model projects continued upward momentum, with 12-month forecasts averaging around 1,400-1,500 GWh per month.

More From Investopaper:

Comprehensive Analysis of Tourist Arrivals and Stay Patterns in Nepal (1964-2024)

A Study on Evolution and Growth of Banks & Financial Institutions in Nepal